variable life insurance face amount

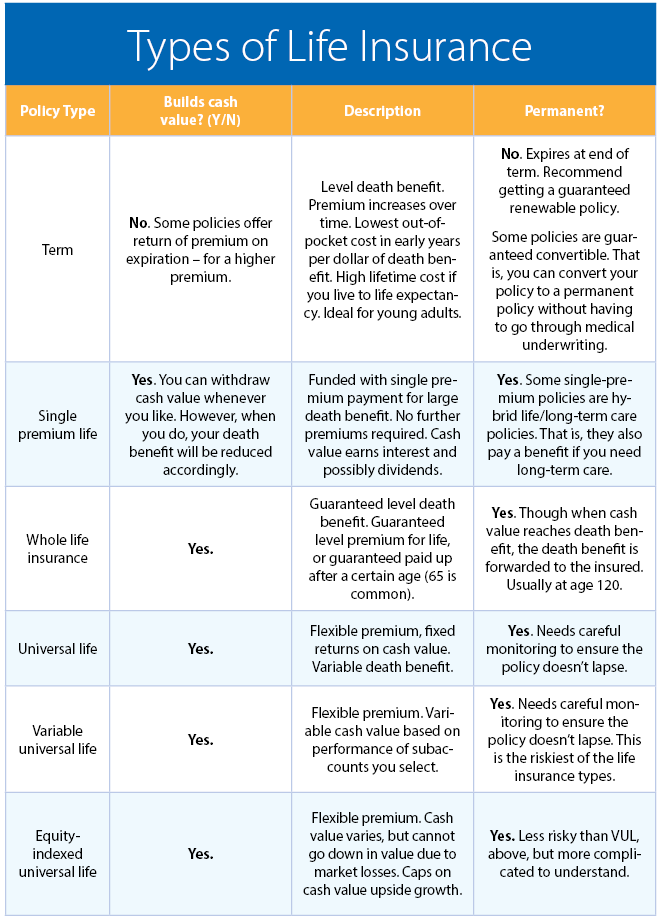

See if you qualify in under 10 Minutes. Variable universal life VUL insurance as the name suggests is a policy that combines variable and universal life insurance ie flexible variable life insurance.

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

These additions may be either positive or negative.

. A permanent life insurance policy has a face value also known as the death benefit. The face amount plus the cash value of your account. The face amount.

Your cash value grows at a fixed rate set by the insurer and is therefore called guaranteed cash value. The face amount plus the amount of premium payments you contributed to your policy. The face value or face amount of a life insurance policy is established when the policy is issued.

If the insured dies. See if you qualify in under 10 Minutes. An insured purchased a variable life insurance policy with a face amount of 50000.

Face amount life insurance definition life insurance face amount meaning life insurance face value face amount of policy industrial life insurance face amounts what is face amount face. Variable life insurance is marketed as a solution that lets you protect your family with life insurance and also earn money with high-risk investments. According to Statista the average Face Amount of Life insurance purchased in the United States in 2015 was about 160000.

Usually the death benefit includes the face amount plus. Statistics about Face Amounts. Life Insurance Face Amount - If you are looking for the best life insurance quotes then look no further than our convenient service.

See how variable life insurance policies compare to whole life. The cash value amount is not guaranteed and depends on market conditions. Over the life of the policy stock performance declined and the cash value fell to 10000.

In 2017 that number grew to. The face amount is the purchased amount at the beginning of life insurance. Variable life insurance also called variable appreciable life insurance provides lifelong coverage as well as a cash value account.

Face amount life insurance definition industrial life. Simply put the life insurance face. Its the amount of death benefit purchased which indicates the amount of.

An insured purchased a variable life insurance policy with a face amount of 50000. When the policy matures the cash value must equal the face. Ad Cash in your life insurance policy.

Any type of life insurance may qualify including term whole universal and more. Variable face amount the face value of indexed life insurance policies varies with the performance of the financial index the policy follows. Variable universal life insurance VUL is a form of cash-value life insurance that offers both a death benefit and an investment feature.

The face amount at. This is the dollar amount that the policy owners beneficiaries will receive upon the. It can also be referred to as the death benefit or the face amount of life insurance.

Variable life insurance is a form of life insurance that combines the characteristics of life insurance and investment. The face amount plus the amount of premium payments you contributed to your policy. Any type of life insurance may qualify including term whole universal and more.

The face amount is stated in the contract or application. On the contrary the death benefit is the. If the insured dies.

Variable Universal Life Insurance - VUL. Over the life of the policy stock performance declined and the cash value fell to 10000. Variable life insurance has a guaranteed minimum death benefit that can fluctuate over time.

Ad Cash in your life insurance policy. The face value of life insurance is the dollar amount equated to the worth of your policy. Account are applied to cause the face amount to vary through the periodic purchase of fully paid-up whole life additions.

If the face amount of. The face amount plus the cash value of your account.

What Is Variable Life Insurance U S News

Variable Life Insurance Investing Cash Value Paradigmlife Net Blog

Form Of Application For Life Insurance

What Are Paid Up Additions Pua In Life Insurance

/universallife.asp_final-89869733efb04ea985873df2c74f4e3f.png)

What Is Universal Life Insurance Ul Benefits And Disadvantages

What Are Paid Up Additions Pua In Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

How Variable Life Insurance Works Pros And Cons Valuepenguin

Personal Finance Another Perspective Insurance 2 Life Insurance Updated Ppt Download

How Variable Life Insurance Works Pros And Cons Valuepenguin

Tax Deductibility Of Life Insurance What To Know 2022

The Problems With Variable Universal Life Insurance

Understanding Life Insurance What Policy Type Is Best For You

Ppt Variable Variable Universal Life Insurance Powerpoint Presentation Id 6777643

Life Insurance Loans A Risky Way To Bank On Yourself

Types Of Life Insurance Policygenius

What Are The Different Types Of Permanent Life Insurance Policies Iii